Understanding Forex Trading: What is Leverage?

Forex trading allows individuals and institutions to trade currencies and profit from fluctuations in exchange rates. One critical concept in forex trading is leverage, which can amplify both potential profits and risks. Leverage enables traders to control a larger position in the market with a smaller initial investment. This article will explore the fundamentals of leverage in forex trading, how it works, and tips for using it effectively. For traders looking for reliable forex trading what is leverage Trading Brokers in Bangladesh, understanding leverage is essential.

What is Leverage in Forex Trading?

In the simplest terms, leverage in forex trading refers to borrowing money from a broker to increase the size of a trade. It allows a trader to control a position much larger than their initial capital. For example, if a broker offers a leverage ratio of 100:1, a trader can control $100,000 in the market by only depositing $1,000 of their own funds. The rest of the money is borrowed from the broker.

How Leverage Works

Leverage is usually expressed as a ratio, such as 50:1, 100:1, or even 500:1. This ratio indicates how much capital a trader can control relative to their own investment. The larger the leverage, the smaller the amount of capital needed to enter a trade. However, while it increases the potential for higher returns, it also significantly raises the risk of loss. If the market moves against a trader’s position, they can quickly lose their initial investment.

Examples of Leverage in Forex Trading

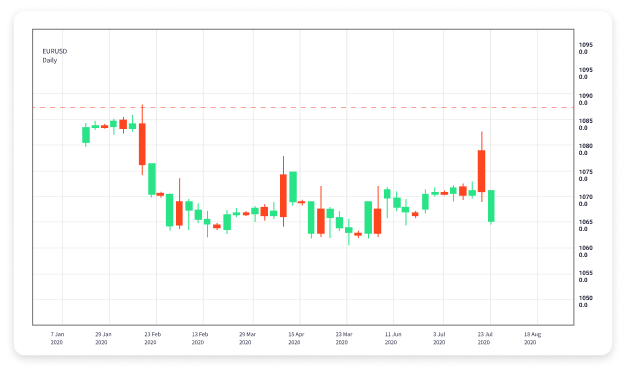

Let’s consider a practical example. Suppose a trader wishes to buy one standard lot (100,000 units) of EUR/USD. At a leverage of 100:1, they would need $1,000 in their trading account to open this position. If the trade goes in the trader’s favor and the price increases by 100 pips, they could potentially make a profit of $1,000. Conversely, if the market moves against them and they face a loss of 100 pips, they could lose their entire initial investment of $1,000.

The Advantages of Using Leverage

The primary advantage of leverage is the ability to amplify potential profits. Traders who use leverage can access larger positions without needing significant capital. Additionally, leverage can provide opportunities to diversify trading strategies and invest in various currency pairs. For those with a sound trading strategy, leverage can enhance the overall return on investment.

The Risks of Using Leverage

While leverage can enhance potential returns, it also exposes traders to substantial risks. As highlighted in the previous example, a small adverse move in the market can lead to significant losses, potentially wiping out a trader’s account. Moreover, high leverage can lead to margin calls, where brokers require traders to deposit additional funds to maintain their positions. This can happen quickly if a trader fails to respond to market fluctuations.

Best Practices for Using Leverage in Forex Trading

To effectively navigate the risks associated with leverage, traders should adhere to several best practices:

- Use Appropriate Leverage Levels: Choose a leverage ratio that matches your risk tolerance and trading strategy. New traders may benefit from lower leverage to minimize their exposure.

- Implement Stop-Loss Orders: Utilize stop-loss orders to limit potential losses. This ensures that trades automatically close at a predetermined price, protecting your capital.

- Maintain a Solid Risk Management Strategy: Set clear risk management rules, such as only risking a small percentage of your total capital on each trade.

- Stay Informed: Keep updated on market trends and economic indicators that can influence currency prices. Being informed can help you make better trading decisions.

Conclusion

In conclusion, leverage is a powerful tool in forex trading that enables traders to magnify their potential profits and risks. While it can open up opportunities in the forex market, it is crucial to approach leverage with caution. Traders should understand the mechanics of leverage, assess their risk tolerance, and implement effective risk management strategies. Those who can balance the potential rewards of leverage with the inherent risks can navigate the forex market more successfully and achieve their trading goals.

By comprehending the intricacies of leverage, forex traders can better harness this tool to maximize their trading performance while safeguarding their capital.