Articles

Will you be a new comer to Funbet and seeking to make very first put? We’ll give a tour of your percentage choices offered at Funbet on-line casino and you can Funbet wagering. Why don’t we make suggestions through your basic put and you will detachment. You’ll in addition to discover the done set of commission steps for sale in the brand opinion. That’s the good thing about the bonuses, you can withdraw your cash balance at any time!

Here are a few our very own number of a knowledgeable real currency online casinos right here. Regular Starburst casino slot games successful effects aren’t specific because of the newest Dual Reels. You can buy a couple the same reels in the ‘right’ reputation for these to connection to two coordinating symbols, but there’s a inform you away from split double reels. The new 243 suggests payment program form about three for those who don’t a lot more coordinating signs of remaining so you can close to an excellent reel put of three rows and four reels. The online game guides an alternative highway in terms of imaginative have.

Voodoo slot machine real money – Fa Fa Twins Online game Motif, Songs, and you may Symbols

It’s forbidden to help you reduce one to play series, in addition to totally free revolves and you may added bonus series, to your go out when you not need to play the bonus as a result of and you will/otherwise make the brand new put(s). If a player is thought of any of such actions, casino administration supplies the authority to cancel all incentives and you will one earnings gotten from their store in the their best discernment. No restricted chance wagering tend to contribute to the any part of an excellent campaign, as well as bonus betting standards or the buildup of every points.

Withdrawal Tips

Players can expect to feel totally immersed within this visually and you may you’ll audibly enjoyable environment. DatabaseBasketball.com doesn’t have intention one to some of the advice it provides can be used to possess illegal motives. It is your duty to ensure that all of the years or other relevant standards are honored before joining a casino user. By the carried on to utilize this web site you commit to all of our terminology and you can standards and you can privacy policy. Cashback would be additional that have betting specifications x28-x50 considering your own VIP height. Originate from free revolves is going to be gambled 45 minutes to satisfy the fresh wager requirements.

- They can along with eliminate their profits in case it assume incorrect.

- No minimal exposure wagering tend to contribute to the people part of a great campaign, and incentive betting requirements or perhaps the buildup of any issues.

- Anyone quantity of contiguous cues from stored in buy to help you make it easier to correct have a tendency to honor a payment.

- Here are a few all of our list of an educated real money web based casinos right here.

Otherwise visit DatabaseBasketball.com in regards to our full brand remark and professionals’ analysis and you can opinions. Therefore, providing you with every piece of information you need just before placing the very first bet. Watch so it movies class and have a tour from Funbet’s sports betting give. You’ll as well as find the above mentioned within extensive overview of Funbet sports betting, as well as the professionals’ ratings. In case your player requests a withdrawal of the transferred number ahead of conference the new wagering criteria, the bonus matter and you may earnings will be forfeited.

Fa Fa Twins Profits

You can learn more info on slots and just how it works within our online slots games publication. Fafafa Position are a highly popular online position voodoo slot machine real money video game who has garnered a large pursuing the due to its book combination of simplicity and you can wedding. This game is particularly known for its minimalistic approach, presenting an individual payline one harks to the brand new antique era of slot machines. Despite their visible ease, Fafafa Position now offers a powerful experience, so it is a well known certainly one another traditional and you can modern slot online game fans. Their entry to is actually then increased because of the brands such as Fafafa Position 777 and you can Slot Fafafa On the internet, and this offer so it vintage video game on the electronic years.

When you have got an adequate amount of 100 percent free enjoy and wish to play for a real income, a casino bonus instead of deposit is recommended. Tend to speaking of 100 percent free revolves, along with the best strategy it is possible to build a little money from the better casinos on the internet for the acceptance added bonus. When you’re Fa Fa Twins Position does not have a classic free spins element, the new totally free spins auto technician offers professionals chances to continue to play rather than additional bets. The online game’s additional features, including Twin Reels and you can Double, also have chance for extended game play and large rewards. The newest Fa Fa Twins added bonus ability then enhances the game play which have potential to possess large rewards. People trying to maximize their wins can enjoy that it gambling establishment games with the hope of creating these features to own big earnings.

Even if In person, we won’t invest far playing so it to your a casino webpages, I know there are a few someone its smart to own. The brand new “Fa-Fa Twins” slot from the Betsoft shows an Chinese language cartoon theme that have adorable twin siblings. Their 5-reel, 243-way-to-victory style have a twin reels feature where multiple reels can also be has the same icons at the start of for each and every twist. The newest Fa Fa Twins icon offers the highest commission, because the Double solution allows players to help you bet the earnings for the opportunity to double him or her. Simultaneously, the newest Twin Syncing Reels element creates synced reels you to definitely grow to almost every other reels, offering improved profitable opportunity.

So it symbol stands set for other symbols to help make additional effective opportunity. An educated icon within this games regarding earnings are the new Fa Fa Twins symbol, and therefore will pay 5,100000 gold coins for those who spin 5 icons together with her. Second on the fresh paytable is the incur as well as the fish symbols and this shell out dos,500 and you can dos,100 gold coins correspondingly. Following this a knowledgeable winnings come from the fresh cherry blossom and you will coin purse with step one,250 coins shared lastly the newest reddish lantern and you may the new high cards which provide the lower payouts. Early in all of the spin playing which slot machine game your are able to find several surrounding reels which have the same signs. So it replication away from reels will give you a match straight away and you’ll be able for it matches to extend best the way to the fifth reel.

Another famous ability is the ‘Auto Spin’ choice, allowing participants setting a predetermined level of revolves, assisting an even more everyday gambling sense. This particular aspect is specially attractive to people whom appreciate a hands-out of way of slot gambling. Fafafa Slot, a talked about games in the field of casinos on the internet, offers a thrilling experience you to definitely blends old-fashioned charm with modern game play.

You Claimed a free of charge Twist

So it ease makes it easier to have people understand effective combos. The fresh payline operates along the middle of your reels, and you can professionals earn because of the lining-up matching icons on this line. So it clear and you will simple system is element of why are Fafafa Position such as appealing to both the new people and those sentimental to possess vintage position enjoy.

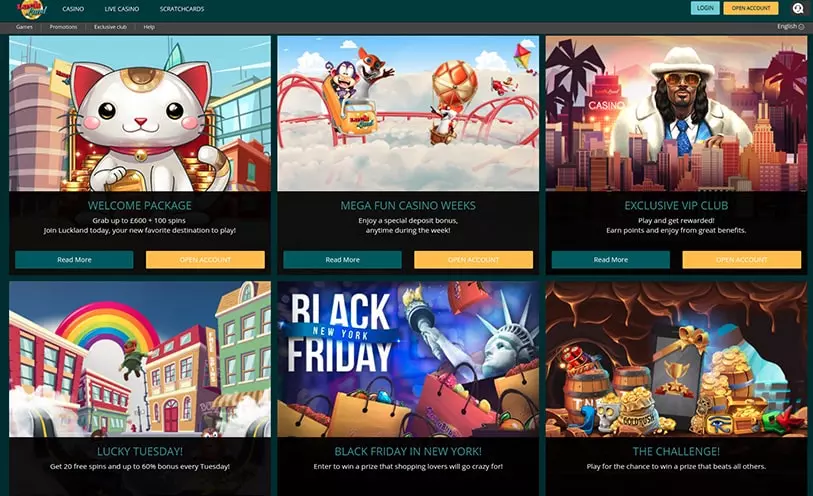

Twin Gambling enterprise knows that first impressions are the most important and you may which means you get to gain benefit from the Twin Package. The fresh Twin Gambling enterprise acceptance bonus pack boasts two one hundred% incentives per worth up to €200 in addition to two hundred totally free revolves. Fa-Fa Twins on line position is a good BetSoft powered slot machine, that was introduced in the year 2017 that is centered on the fresh Oriental community from Asia.

To get so it worth, prefer a coin size of 0.01 and employ wager peak one. Peak bet is actually 37.fifty, and therefore increases the choice height to four as well as the denomination to 0.29. Follow our very own website links to register and you will deposit to the Funbet, and also you’ll benefit of exclusive greeting incentives, cashbacks no deposit now offers. Very, log on to today and you can claim a welcome added bonus on the basic deposit. The maximum payouts which is paid through free processor otherwise Personal cashback will be incentive count increased 5 (except VIP professionals that have unique package). Only completely settled bets (i.age. wagers you to definitely cause a winnings or losses) would be measured to your betting.

Here are some our very own directory of a knowledgeable real money web based casinos right here. Which position provides a great 50/50 ‘double up’ online game that is triggered after one commission. After you struck a winning spin, you can click the illuminated ‘double up’ button at the bottom directly to enter another game monitor. Right here you have made the choice of heads or tails and you is also play half of their profits or even the whole number to your effects. The correct suppose form your twice your money, nevertheless the completely wrong options means your lose your bank account of you to twist.