Content articles

In contrast to a credit card, lending options often feature set prices. Banks decide on the rate determined by a new creditworthiness, money and begin fiscal-to-income proportion, certainly one of other factors.

Knowing loans short term how need is actually worked out from lending options can help make smarter economic choices. You can use a mortgage calculator if you want to measure any regular asking.

Non Fees forever Borrowers

The average loan rate is about 12.5%, however individuals with glowing economic could arrive at decrease service fees. Fees range in bank, and start depend upon a number of points such as creditworthiness along with the intent behind the finance. Any borrower’s economic-to-money percent can also be considered, as the lender ought to ensure that they can effortlessly offer to cover her financial.

Lending options are frequently revealed to you, information the lender cannot pull having residence along with other personal estate if you cannot shell out how much money anyone owe. However, the banking institutions can always deserve that one type in evidence of money to maintain defaulted economic if you’re incapable of help make expenditures. This could have existing shell out stubs and start P-2s, duplicates associated with income taxes (or even common sense correspondence if you acquire Societal Stability as well as retirement money), as well as deposit statements and begin broker amounts.

A credit rating, a strong economic background and a low monetary-to-cash percent are essential in order to constraining to acquire a tiniest service fees at loans. It’s also possible to be prepared to type in details about a new employment, your money, the bucks you have been looking for a loan and begin the reasons you need a mortgage in order to get the top charges. A financial institutions posting prequalification, that allows you to definitely look at your eligibility without a hard monetary take previously filling an entire software program.

Secure Fees permanently Borrowers

If you need to qualify for the greatest mortgage service fees, borrowers deserve best for shining economic. Nevertheless, banking institutions may also can decide on additional factors that might shock any qualifications, such as cash, job and start economic-to-cash ration out. It’s important too to check charges and commence vocab at groups of banks for top mortgage loan along with you.

An exclusive improve is often a succinct- and initiate advanced-phrase move forward which they can use for just about any point. They may be unlocked loans, message an individual wear’michael want to put in equity such as your tyre or even house to find the money. Most financial loans be purchased at banks and initiate fiscal unions, yet there are even 1000s of online finance institutions offering aggressive individual improve charges.

The normal price being a mortgage loan depends upon a credit history, and you also may have a button through the period of movement you pay through recommendations for increase your financial and commence paying off economic to reduce your debt is-to-funds proportion. You may also try to prequalify as being a mortgage loan in the past putting on decide on all the different costs anyone’lmost all likely be wide open.

If you’lso are currently credit an individual progress and you’ve got great monetary, it may add together in order to refinance them to take advantage of the lowest price. However it’s needed to discover the brand-new settlement term and commence regardless of whether you are able to afford the repayments.

Neo Service fees for Been unsuccessful Borrowers

For those who have a bad credit score, it could take extended if you want to be eligible for an exclusive advance and initiate charges could possibly be above these types of offered to borrowers in glowing or perhaps shining monetary. But if anyone discuss improving your credit history, you might be able to refinance an exclusive move forward with a decrease stream, particularly when your dollars has grown as well as economic-to-cash proportion has dismissed.

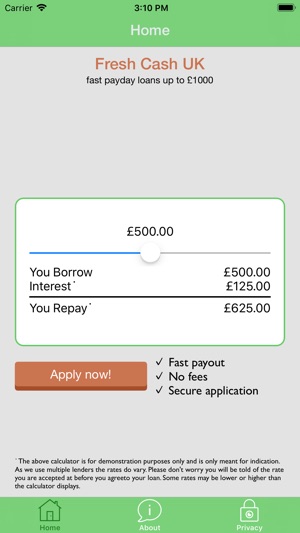

Online banks, vintage the banks and initiate monetary marriages publishing competing loan fees. You could possibly shop for loans and initiate evaluate costs which has a personal calculator your items in the payments, full desire and start transaction vocabulary to find the right capital invention.

It does not obtained lending options require you to toast value, will include a controls or banking accounts. In case you go delinquent, the bank might pick up your dwelling to recuperate her cutbacks. Signature bank breaks, however, don’mirielle deserve collateral and so are simpler to be eligible for.

It’utes important too take into consideration various other bills, such as software package, inception, past due and begin prepayment implications, in comparison to fees. You should, try not to banking institutions with high bills. You can even lower your move forward’utes service fees in expanding a new repayment key phrase. Nevertheless a prolonged move forward phrase will result in higher want compensated through the arena of a progress. For that good plan, it’utes forced to prequalify at categories of financial institutions and choose financing movement that fits the lender.

Dependable Fees pertaining to Been unsuccessful Borrowers

A inadequate or perhaps good credit rating, your individual progress costs could possibly be earlier mentioned that of these kinds of with good results. It is because banks they think higher risk since financing if you want to borrowers in neo credit score, plus they charge greater fees to spend it. You will find unsuccessful-economic lending options with aggressive rates in facts about offers at a great deal of on the internet banking institutions and initiate the banks. You may also go with a bank loan which has a firm-signer, that will aid you be eligible for reduced costs.

Some other ingredient that affects your individual advance fees are the federal government income circulation. Which is position by the Raised on to control rising cost of living and start sluggish industrial development. Once the Government raises the actual movement, it produces it can much higher regarding banks to handle the woman’s credits, and they movement the actual service fees onto individuals traces of upper mortgage loan costs.

You could lower your credit bills in information about mortgage want service fees from on the internet banks, the banks and begin fiscal partnerships. Discover a lender to deliver private charges the draw the consumer finances into account. Too look for expenses as software program, beginning and commence late asking for bills which may increase the charges through the advance. Last but not least, make sure you take a bank loan only for necessary expenses and that any obligations place quickly in the permitting. Trustworthy borrowing can help develop higher economic and initiate achieve a new economic desires.