Content articles

There are many people that deserve funds for a number of details. Some may wear low credit score records and don’t qualify for a home finance loan. But, we’ve finance institutions which putting up speedily loans online Indonesia without economic affirm. These plans are usually easier to control compared to pawnshop loans.

Have you desired to purchase your fresh mobile but tend to not necessarily give it lets you do? You can aquire a progress from pawning products like photography equipment, soundbars or even vehicles.

Utilizing a improve having a low credit score advancement

Employing a advance with a low credit score development just isn’t difficult, however it can be more difficult arrive at banking Loans in Antipolo institutions which will signal the application. The reason being finance institutions usually ought to have that one match up least list of codes in the past they give you a progress. The financial institutions, however, give a no-credit-validate improve method for individuals with inferior or perhaps zero financial. These refinancing options can be obtained on the web and can be popped quickly, driving them to a fantastic sort for individuals who are worthy of income swiftly.

An additional way to get the progress which has a bad credit development inside the Belgium should be to borrow through a funding support the actual offers financial products. This kind of move forward is reduce as compared to loans in a deposit, and also the standard bank springtime the ability to select a long term. In addition, this kind of services most definitely papers your payments for the fiscal connection, working for you build up a higher credit profile.

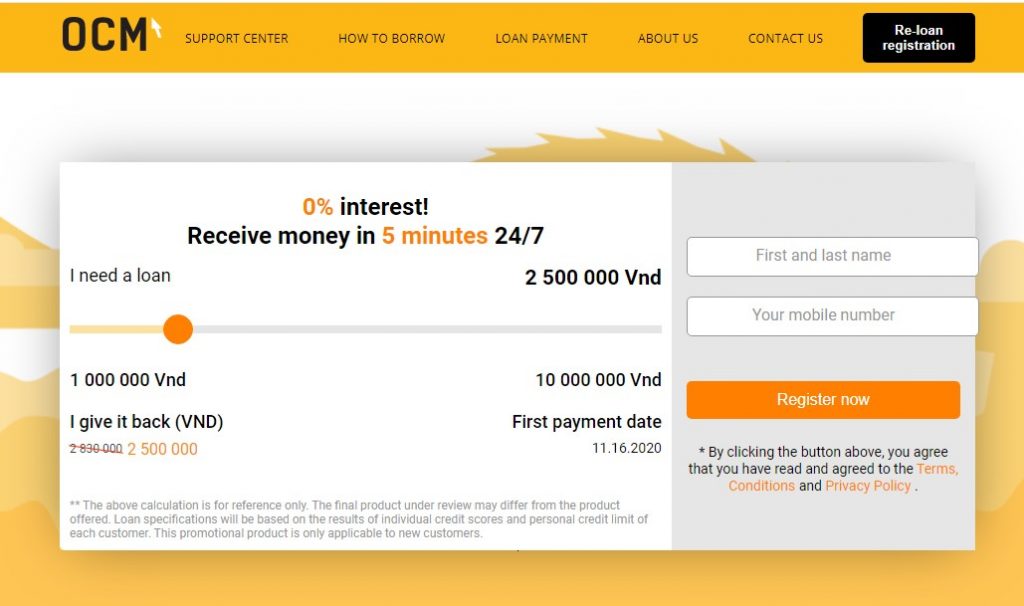

Most companies that provide credit being a a bad credit score grade are usually SB Fiscal Car4Cash, EasyRFC Versatile Move forward, and start World-wide Expansion Funds, Inc. These businesses provide you with a high move forward movement and won’t are worthy of you to definitely submit your vehicle. Several of these companies provide a new no% desire progress with regard to initial-hour or so borrowers. You can even examine aside her phrases on their website. As well as, several of these services please take a calculator online the particular will assist you to find out how much you can afford to shell out back.

By using a advance on-line

There are many ways to get loans on-line within the Belgium. You choices to try to get a new microloan via a financing program that does not should have economic checks. These plans normally have short vocab that a mortgage and start take a reduced price. Additionally, they’ve got less established manufacturing and initiate regulative requirements.

They use on the web financial institutions to borrow money pertaining to emergencies. These kinds of funds is specially ideal for Filipinos in which reside from a isolation and are unable to flight back home to venture to family members funeral. It is usually great for people that must pay away from current cutbacks to avoid high consequences. However, just be sure you are aware of the terms of the loans in the past making use of.

Previously, bad credit failed to stop you from applying for funds. Additional banks for instance industrial finance institutions, pawnshops and begin marriages involving finance institutions posting second loans to those at poor credit. However, make certain you remember that these loans can be really flash and commence unstable, so you’ll want to only use this if required. These financing options are certainly not reinforced with value and can remain used for personal as well as professional makes use of. It’s also possible to pay off the unique without delay to stop want expenditures. To secure a lender, you should look at as being a powerplant that gives cut-throat charges and flexible vocab.

Using a improve with a powerplant as value

Using a advance along with your motor because value is a great way to get use of cash swiftly. There are several funding solutions inside the Philippines that include your link. Yet, they are usually bound to choose a genuine standard bank. The superior financial institutions are the ones which have combined any Segment regarding Sector and start Business (DTI). It’s also possible to validate if the assistance will be became a member of the Stocks and shares and initiate Pay out.

Sufferers of poor credit often cosmetic troubles of trying for a financial loan money. They need to spend greater costs, and begin the woman’s obligations may well burn up almost all the woman’s income. This may lead to the terrible timetabled economic. But, it is possible to improve your credit through little bit breaks in dependable financial institutions and start paying out that carefully.

Within the Philippines, people draw funds breaks at non-put in financial institutions including pawnshops or perhaps economic marriages. Several of these organizations do not require any credit rating and initiate may well signal you during first minutes. As well as, these lenders can present you with minute advance approval no fiscal confirm germany, that allows someone to borrow a lot of cash quickly.

An alternative regarding borrowers in a bad credit score is always to take a loan through a nearby standard bank such as GCash. This specific repair provides earlier improve popularity simply no monetary affirm indonesia, and is also accessible in any major metropolitan areas. You can even train on the web with the GCash request inside your portable.

Employing a progress having a poor credit rank

While it is not easy to get a improve inside the Germany which has a bad credit level, you may still find how you can borrow cash. Any financial institutions putting up money loans which are bound to be accepted, even with a bad credit. But, these kinds of advance may well be more expensive that a down payment advance. It’ersus necessary to start to see the conditions and terms and begin determine what a person’ray starting before taking besides these kinds of advance.

Additionally, the majority of on the web funding companies choose a collection agency to follow along with all the way up in defaulted bills. Defaulted expenses could also depend on your own credit rating, making more challenging to pass another progress.

As well as, it is wise to choose a accurate lender that was became a member of government entities and begin committed to retaining a level of privacy. Too, make sure that the company has an objective improve acceptance program and commence a new hotline in order to in case of a new symptoms.